Aircraft Delivery Delays Explained

Both manufacturers are grappling with challenges that hinder their ability to clear backlogs, which currently stand at over 6,184 for Boeing and more than 8,585 for Airbus. The reasons for these delays are varied, including supply chain bottlenecks, employee turnover, the lingering effects of COVID-19, and even plane crashes.

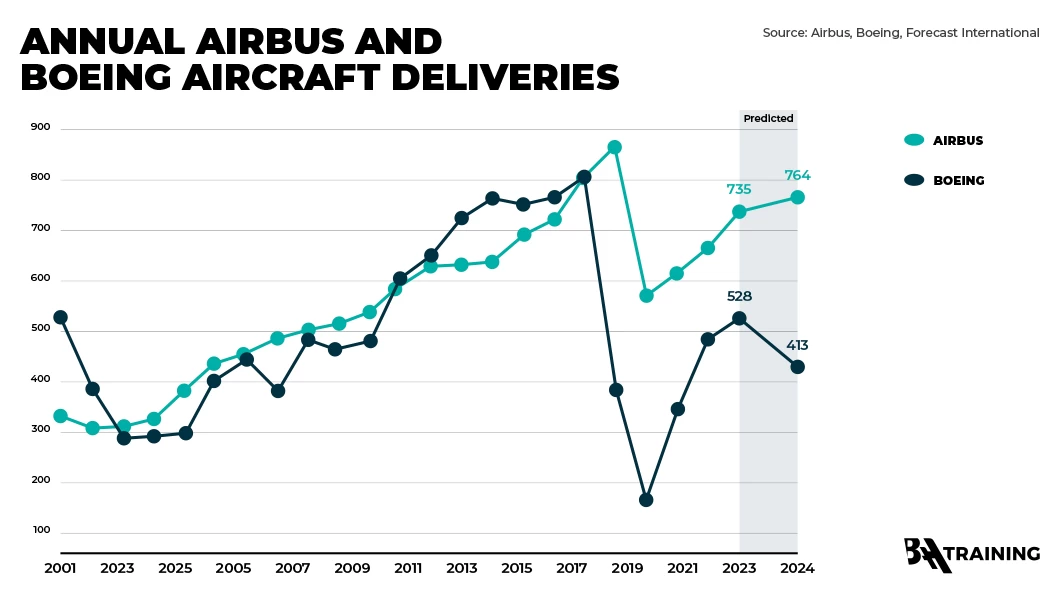

2024 Aircraft Delivery Predictions

For 2024, Forecast International’s analysts expect Boeing to deliver 413 commercial jets, which represents a nearly 22% decrease from last year. In contrast, Airbus is projected to deliver 764 jets, which is a 3% increase compared to the previous year.

While the above trend suggests Airbus’s ability to deliver is stronger than Boeing’s, it isn’t strong enough to accommodate the demand, which is also generally stronger than Boeing’s.

Airbus’s CEO recently said that they have more demand that ability to supply—when a couple of the thousands of suppliers are late on the ramp-up, is slows everybody down.

Supply Chain Bottlenecks

Airbus is struggling to obtain engines from manufacturers like CFM International and Pratt & Whitney, which is particularly affecting the high-demand A320neo and A220 models. An average of 350 Airbus A320 family planes is estimated to be grounded annually from 2024 through 2026, leading to capacity reductions for certain airlines. For example, Wizz Air had to cut capacity by approximately 10%.

Boeing’s Complicated Situation

Boeing’s troubles are compounded by a history of safety issues, including two deadly 737 MAX crashes in 2018 and 2019 that temporarily halted production. More recently, a near-catastrophic incident involving a mid-air panel blowout on an Alaska Airlines 737 MAX 9 in January 2024 has led the Federal Aviation Administration (FAA) to restrict Boeing to a 38-jet monthly production rate until quality controls are assured. Additionally, delays with the 777X widebody aircraft, originally slated for delivery in 2021, have postponed the first deliveries to 2026. The ongoing strike involving the International Association of Machinists and Aerospace Workers (IAM) has also slowed production at key facilities, affecting the 737 MAX and 777X programs. Just days ago, Boeing announced it would be laying off 17,000 employees, comprising 10% of its workforce.

According to Reuters, Ryanair was supposed to receive 20 deliveries from Boeing before December, but now the airline expects them to be delayed until next year, which has made it cut its 2025 traffic forecasts.

Airlines Strategize Differently

Headlines stating that various airlines are halting training and recruitment due to aircraft delivery delays have become common in news media outlets. But does this mean aspiring pilots should reconsider their career choice?

Softening Airline Recruitment

Martynas Mazeika explains: “It is true that certain airlines not only slow down training and recruitment for the summer season but also continue to do the same during fall and winter seasons. However, this is more drastic in the USA than Europe, particularly concerning American Airlines, Spirit Airlines, Delta Airlines, and United Airlines.

“But let’s not forget that a significant number of pilots will be reaching retirement age soon. For instance, America anticipates that up to 850 pilots will retire annually over the next five years. This expected turnover indicates that while hiring is slowing, new pilots will still need to fill the gaps left by retiring personnel.

“This is why drawing conclusions about pilot job prospects based solely on aircraft delivery factors would be wrong.”

Still Battling Pilot Shortage

The long-term demand for newly qualified aviation personnel remains strong, as 155,000 new pilots will be needed in Europe and Asia over the next 20 years, according to Boeing’s forecast. A recent example of pilot shortages can be seen with KLM Airlines, which has asked its part-time pilots to work full-time to prevent grounding part of its fleet.

“In 2023, many airlines in Europe, battling pilot shortages, raised their salaries by approximately 5-10%, with some specific roles, such as pilots, seeing even higher increases. In the USA, there were increases of up to 50% recorded,” shares Mazeika.

Turning To ACMI Companies for Help

When the aircraft you have been counting on does not arrive on time, and you need to accommodate the capacity, turning to ACMI (Aircraft, Crew, Maintenance, and Insurance) companies is often the best solution.

For instance, Wizz Air, facing A320neo delays, and Finnair, waiting for delayed A350s, have adjusted parts of their business strategies to maintain operational capacity.

The increased demand is evident in the financial results of ACMI businesses. For example, Dublin-based Avia Solutions Group, the world’s largest ACMI provider and parent company of BAA Training that operates a fleet of 214 aircraft, reported first-half revenues of €1.2 billion, a year-on-year increase of 29% and a 44% increase in net profit for the second quarter of 2024 compared to the same period in 2023.

Your PILOT CAREER

starts with a first click

Interestingly, airlines are not only turning to ACMI companies; some are exploring the business themselves. For example, Norwegian Air Shuttle illustrates the potential profitability of entering the ACMI sector. While not an ACMI airline, it has engaged in dry leasing, where it leases only the aircraft (without crew or additional services) to other airlines or operators.

Pilots Are in Demand Nonetheless

According to Mazeika, the current high demand for ACMI businesses opens exciting opportunities for pilots. This could be an interesting path for those considering a pilot career or even for those who have been “put on hold” by airlines mid-training.

“ACMI companies increasingly need qualified pilots to meet the growing demand for their services. For example, to address the pilot shortage, some ACMI operators, like Avion Express and Air Explore, have started sponsoring pilot training through the Pilot Runway MPL program to attract new talent. This approach not only helps the airlines fill critical staffing gaps, but also provides new opportunities for individuals looking to enter the aviation industry.”

The demand for pilots in the future can also be predicted not only from ACMI actively seeking pilots but also from the fact that legacy and other airlines are increasingly opening cadet and MPL programs.

“It isn’t right to start training only when aircraft deliveries begin, as it should be taken into consideration that it takes two years of training until pilots are job-ready. Therefore, preparation in advance is essential, says Mazeika.

“From the pilots’ perspective, it is better to go all-in and not limit themselves to a CPL license only. Without a Type Rating, they simply cannot fly. Therefore, complementing a CPL license with a Type Rating right away or pursuing an MPL license instead, which includes the Type Rating, are both the most viable solutions.”