We’ve examined a number of ATOs from the five largest aviation markets in Europe—the United Kingdom, Spain, Italy, Germany, and France—to see if the pilot training programs differ in terms of fully preparing pilots for their careers.

Current European aviation landscape

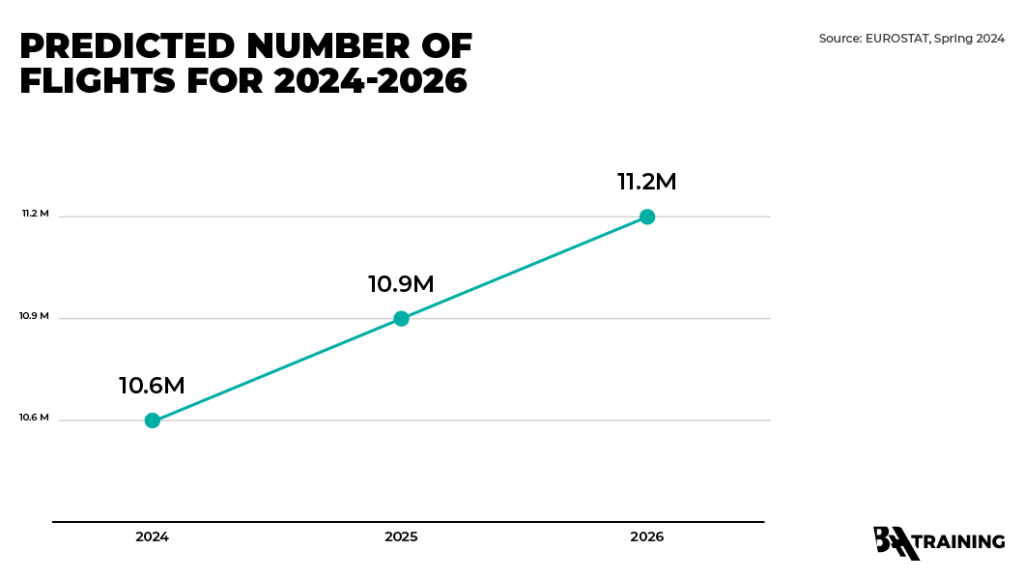

The European aviation industry is experiencing significant growth, fueled by increasing passenger demand. Eurocontrol’s forecast update for 2024-2030 expects the number of flights in 2024 to hit 10.6 million, marking a 4.9% increase compared to 2023. This shows a significant recovery for the aviation industry, which was heavily impacted by the pandemic.

However, it still accounts for around 96% of 2019’s flight volume. This upward trend is predicted to continue, with projections reaching 10.9 million flights in 2025 (almost back to pre-pandemic levels) and exceeding 2019 numbers by 2026 with an estimated 11.2 million flights.

The shifts have ignited a corresponding surge in the need for qualified pilots, urging ATOs to ensure a steady stream of skilled aviators. A similar trend has been noted among European countries regarding interest in pilot training. We have looked at where in the EU people are most interested in pilot training in our previous article, which you can read here.

Data Gathering and Analysis

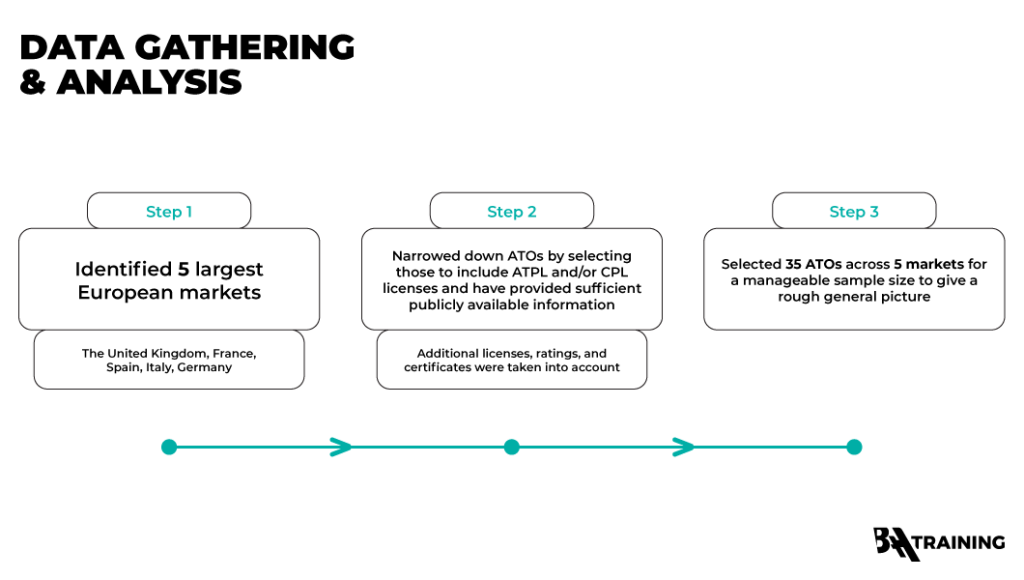

To identify any key differences in pilot training programs offered in Europe, we have used the five largest European markets as a rough benchmark due to their reputation, strong performance, and influence on the aviation industry within the continent. We then looked at the number of ATOs in each country to see how dense the market was, which would play into the findings.

Since we are exploring the training courses for future commercial pilots, we have narrowed the training offered to include the Airline Transport Pilot License (ATPL) program and/or the Commercial Pilot License (CPL) at a minimum. Any additionally offered courses for other licenses, ratings, or certificates were also taken into account to consider the full-scope journey to the pilot career.

In total, we analyzed 35 ATOs across the five markets. When it comes to the researched ATOs, we focused on those Approved Training Organizations that offer at least one of the previously mentioned license programs and had sufficient information about their offered programs. This included program type, training duration, flight school fleet composition, and additional specializations like partner programs, for example. This was necessary in order to have enough quality data to analyze the general picture of the pilot training programs offered in Europe.

Findings

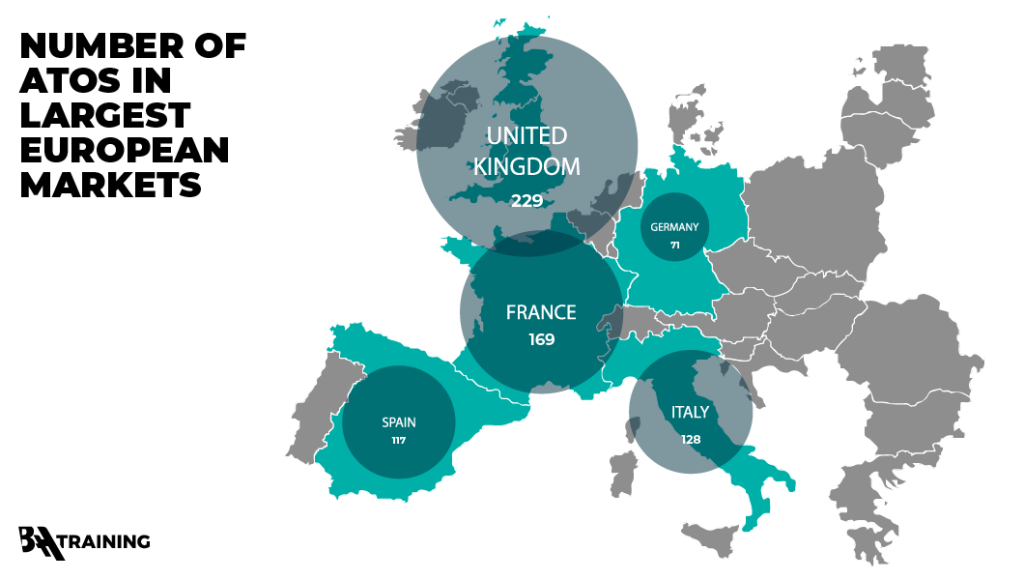

First, to better understand the density of the pilot training market, let’s examine the overall number of registered ATOs in each country. These ATO lists are compiled by the local aviation authorities, rather than EASA itself, and updated in varying degrees of frequency, but, nonetheless, are kept up-to-date.

Number of ATOs in the Five Markets

The dominating market here is the United Kingdom, with 229 registered ATOs operating in the country, followed by France, with 169 (including French overseas regions and territories). Third is Italy with 128, followed by Spain with 117, and then Germany with 71 ATOs.

This gives a pretty good outlook on how saturated the market is. For future pilots, this offers a wider variety of choices, while for the ATOs, this means bigger competition—making their programs more appealing.

Pilot Training Program Overview: ATPL & CPL

Approved Training Organizations in four major European markets, with the exception of the UK, follow the same rules and guidelines set by the European Union Aviation Safety Agency (EASA). That means that the ab initio pilot training program structure, entry criteria, and requirements are generally the same. However, the UK programs also have the same general requirements as the programs in Europe, despite leaving the EU and, subsequently, EASA in 2021.

Looking at the split between the Airline Transport Pilot License and Commercial Pilot License programs offered, around 65.71% of all researched ATOs offered both programs. The remaining 34.29% had only ATPL programs.

The biggest variations, however, come in the form of program type and format.

Standardized Core, Diverse Approach

The flexibility of the program—whether there is a modular option or the possibility of covering the theory phase with distance learning—is a mixed bag. While each of the researched ATOs offered at least one of the aforementioned, Italian stands out the most. The ATOs had at least one modular option for either the ATPL and/or the CPL and a couple of them clearly stated virtual theory options.

While the ATPL Virtual option is rarer, modular seems to be, more or less, a common option in Italy. Modular offers excellent flexibility, but one drawback could be the longer time it would take to complete the program.

Similar ARTICLES

Germany was a close second, with a solid number of modular options, but lacked distance learning options. The UK was at the bottom, with most programs being Integrated ATPL course options, and only a couple of ATOs had an option for remote theory learning.

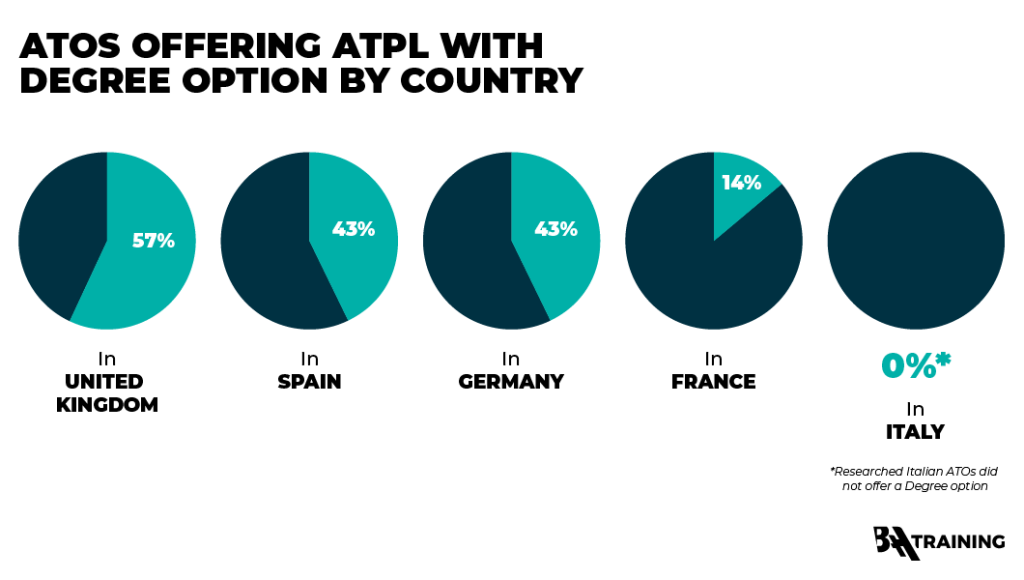

University Degree Integration: A Double-Edged Sword

Overall, the UK, Spain, and Germany have some of the more diverse programs for aspiring pilots. More specifically, ATPL with a higher education degree option. This is one of the more prominent characteristics of the programs offered in the UK, Spain, and Germany. Around 57% of researched ATOs in the UK and 43% in Spain and Germany have a Bachelor’s degree as a separate program or with an option to integrate it.

However, the downside is the duration of the program. It nearly doubles in length. Instead of the average advertised 18 months to complete an ATPL program, it extends to three to four years, making it one of the longest available ATPL program options.

This simply comes down to individual choice and a student’s path. A university degree is not necessary to become a pilot. However, if students are not in a rush to become pilots to clock in flying hours and might think of going on alternative career routes, then they might want to choose a BSc degree option.

Airline Partnership Programs: A UK Advantage

Another notable feature to consider is the number of airline partnership programs that the researched ATOs have. Only 20% of the ATOs had at least one cadet program in partnership with an airline, of which 42.86% were in the UK, behind—Italy. Spanish, French, and German ATOs weren’t as strong in this segment and very rarely boasted such an option.

Your PILOT CAREER

starts with a first click

Fleet Composition for Flight Training

Looking at the ab initio flight training phase, there is an interesting split between the countries in terms of their fleet composition. The fleets at researched training organizations in the UK, for example, primarily consist of Piper PA-28 and PA-44, as well as Diamond DA40 and DA42. French organizations seem to be carrying out flight training on Diamond aircraft (DA40 and DA42), while Germany shows a larger preference for Pipers (PA-28 and PA-44).

Italy and Spain are an intriguing mix across the board, with a roughly similar distribution between Cessnas (C172 and C152) and Pipers (mostly PA-28).

Type Rating Availability—A Gap in the Market?

The results for Type Rating courses did come as a slight surprise. For pilots with a license, planning to further their training on specific commercial airliners like Airbus A320 or Boeing 737 is the next natural step. However, only 28.57% of the researched ATOs across the five markets offered a Type Rating course—whether it was part of an airline cadet program or a partner ATO—and were limited by aircraft type. 71.43% of ATOs drew the line here and focused on specializing in ab initio training.

This means there is a rather small number of organizations that offer full-scope training in one place, which can be a serious challenge for a pilot looking to become a full-fledged commercial pilot.

Conclusion

Though European ATOs offer a diverse range of pilot training programs, significant variations exist across the five markets. Some markets put more focus on the integrated course structure, while others allow for better flexibility with modular approaches or distance learning options.

Additional options like university degree integration or cadet programs with airline partnerships seem to stand out among otherwise uniform program offers. However, only a handful of researched ATOs had such options, which can be a mixed blessing.

Considering the full pilot training journey, the most obvious difference is Type Rating. The clear trend here is that ATOs specialize in either ab initio or Type Rating, not both. While some organizations did offer a course or two, it was still limited by the aircraft type. This can be viewed as a certain characteristic or a gap in the five markets.

Disclaimer

The information provided in this article is for informational purposes only. The views and opinions expressed herein are those of the author and do not necessarily reflect any organization or country’s official policy or position. Please note that the findings presented are based purely on the publicly available data and information presented by the ATOs. Other conditions and circumstances should be carefully considered, and readers are encouraged to conduct further research before making any decisions based on the information provided in this article.