Hypothesis 1:

We’re hypothesizing that the expected shortage of 449,000 pilots in Europe by 2041 (as reported by Boeing) is already causing airlines to offer more appealing working conditions. Potentially, even sponsored Type Ratings to attract new employees for their ever-expanding fleets. The airline competition is fierce, the supply of pilots does not meet the demand, passenger travel demand is rising, and new aircraft are being ordered. All of this creates the perfect environment for new and current pilots to secure better working conditions than ever before.

Hypothesis 2:

Attracting more potential new hires could theoretically be achieved not only by improving the “what we offer” package, but also by lowering the minimum acceptance criteria. However, given that the industry is highly regulated and any compromise at the commercial pilot selection stage might jeopardize airline operations and reputation, not to mention passenger safety, another hypothesis is made: the shortage does not lower the bar for candidate requirements.

Data gathering and analysis

Aiming to identify the airline First Officer position requirements and offerings in Europe, we have thoroughly analyzed 90 recently posted airline job ads. We also aimed to compare and contrast any emerging trends across different types of airlines (legacy/popular low-costs, ACMI/charter/cargo, and regional). Based on our findings, we provide recommendations for aspiring First Officer pilots to enhance their competitiveness in the job market.

Apart from the airline companies’ official career pages, the following websites were used for analyzing the job ads:

- https://www.aviationjobsearch.com

- https://www.aviationcv.com/

- https://pilotsglobal.com

- https://www.aviationjobs.me

- https://www.allflyingjobs.com

- https://www.latestpilotjobs.com

- https://jobs.flightglobal.com

- https://www.linkedin.com

- https://www.pilotjobs.io

- https://www.career.aero

Below is the breakdown of airlines by category, the currently advertised First Officer vacancies of which have been reviewed and analyzed.

Regional: Air Europa Express, Air Dolomiti, Volotea, CityJet, Stobart Air, HOP! France, Wideroe, Air Serbia, TAP Air Portugal, Air Caraibes, etc.

ACMI/charter/cargo: Amapola Flyg Sweden, Avion Express, Electra Airways, Enter Air, Challenge Airlines Belgium, SmartLynx Airlines, TUIfly, RAF-Avia Latvia, DAT, DHL Air, etc.

Legacy/popular low-costs: Air France-KLM, Lufthansa, SAS, Iberia, Lauda Europe, Air Malta, Lauda, Wizz Air, LOT Polish Airlines, French Bee, Austrian Airlines, Transavia France, Luxair, etc.

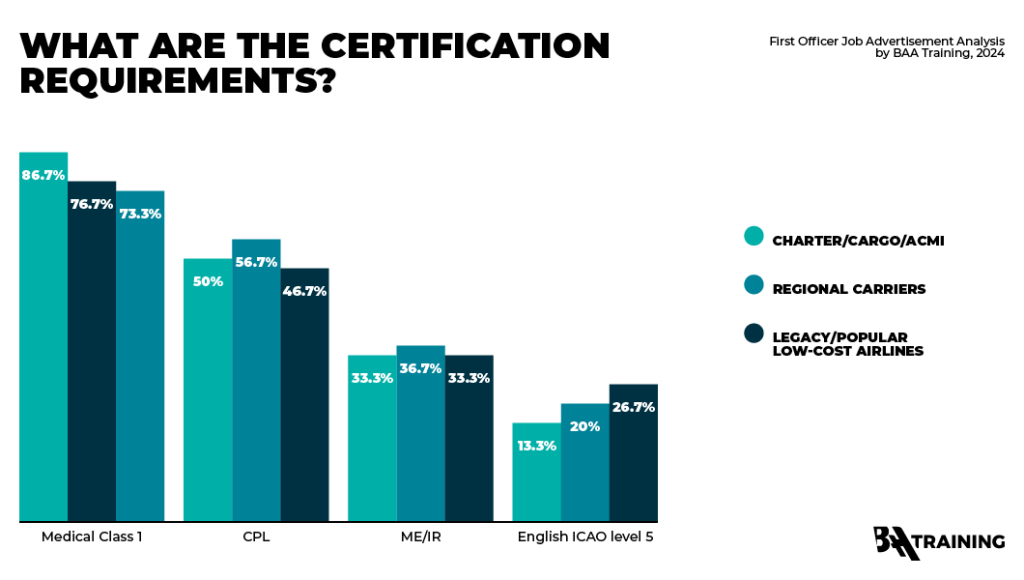

Certification requirements

Due to the stringent regulations governing the industry, airlines do not have full freedom to create their own criteria for the First Officer position. Instead, they must adhere to minimum licensing, certification, and rating requirements active in Europe:

- Commercial Pilot Licence (CPL)

- English fluency ICAO level 4

- Class 1 medical certificate

- Multi Engine rating (ME) and Instrument Rating (IR)

- Multi-Crew Cooperation (MCC)

- Advanced Upset Prevention and Recovery Training (AUPRT)

However, they can impose additional criteria, which was a central point of the study.

The vast majority of the job ads studied in every of the three categories (legacy/popular low-costs, ACMI/charter/cargo, and regional) mentioned the first three bullet points above.

While the remaining qualifications were mentioned less frequently, it can be assumed that they were considered implied, as ME/IR, MCC, and AUPRT are typically included in Ab Initio training syllabuses helping to achieve a CPL license. However, at some schools, modular training programs may omit the MCC and/or AUPRT elements, making it possible to obtain a CPL without them. Therefore, job ads that were more specific enhanced clarity and transparency.

It is essential to note that for aspiring pilots, completing all required courses is mandatory, and opting for a comprehensive package right away is often the most cost-effective and time-efficient solution.

The job ads also indicate that an Airline Transport Pilot License (ATPL) is acceptable in addition to the CPL license, given its higher rank. While a Multi-Crew Pilot License (MPL) is less commonly mentioned in the job ads compared to CPL/ATPL, it may be equally accepted, as there is no regulation prohibiting the change of the operator.

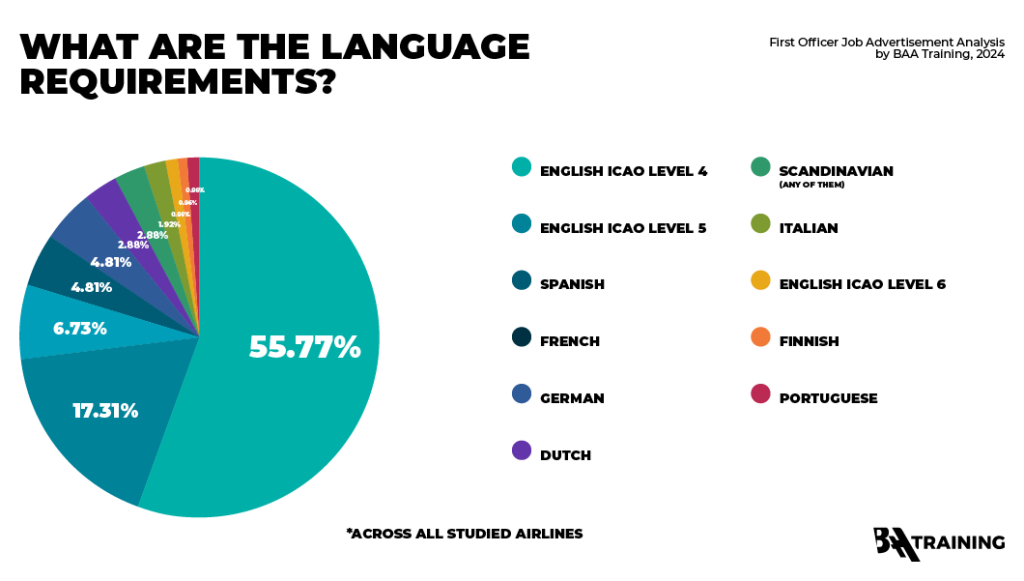

Language fluency requirements

While it is standard practice for most airlines and flight schools to require English proficiency at ICAO level 4 (as evidenced by the research findings reflected in the picture below), the same research has revealed that 17,31% of all job ads prefer candidates to have a higher level of English – ICAO level 5 (with the highest percentage of legacy/popular low-costs indicating it as a requirement).

Although this figure may not be the highest, it is still considerable. This suggests that besides technical and soft skills required for airline operations, focusing on improving English proficiency can potentially secure more versatile career opportunities in the long run, especially with longer-established and reputable airlines.

Surprisingly, despite English being the international language of aviation, other language requirements were also found in job ads, albeit as a vast minority. Some airlines prefer candidates who speak the native language of their base country, sometimes even requiring proof such as exam grades. Spanish, French, German, Dutch, Scandinavian (any of them), Italian, Finnish, and Portuguese were among the most commonly listed language requirements.

Personal characteristics requirements

Among the rarest application criteria (each representing less than 4% of the ads) were height (e.g., 160-198cm or above 165cm), age (e.g., born on or after 1983.01.01), and vision requirements (correction of visual acuity by max. +- 3 diopters), all posted by a fraction of legacy airlines only. Vaccination against COVID-19 appeared as a requirement for 6,7% of ACMI/charter/cargo airlines and 10% of legacy/popular low-cost airlines.

Type Rating Requirements

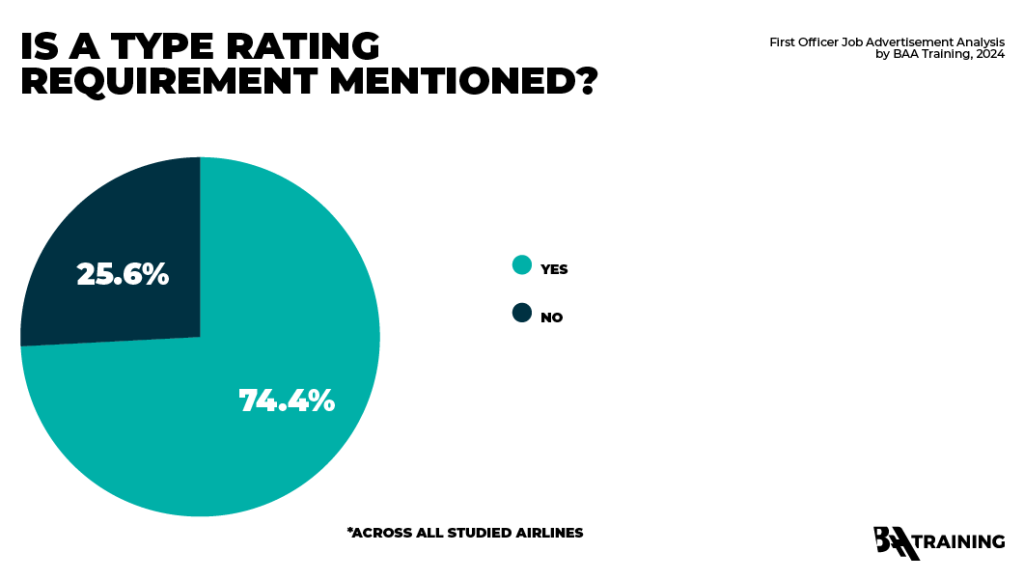

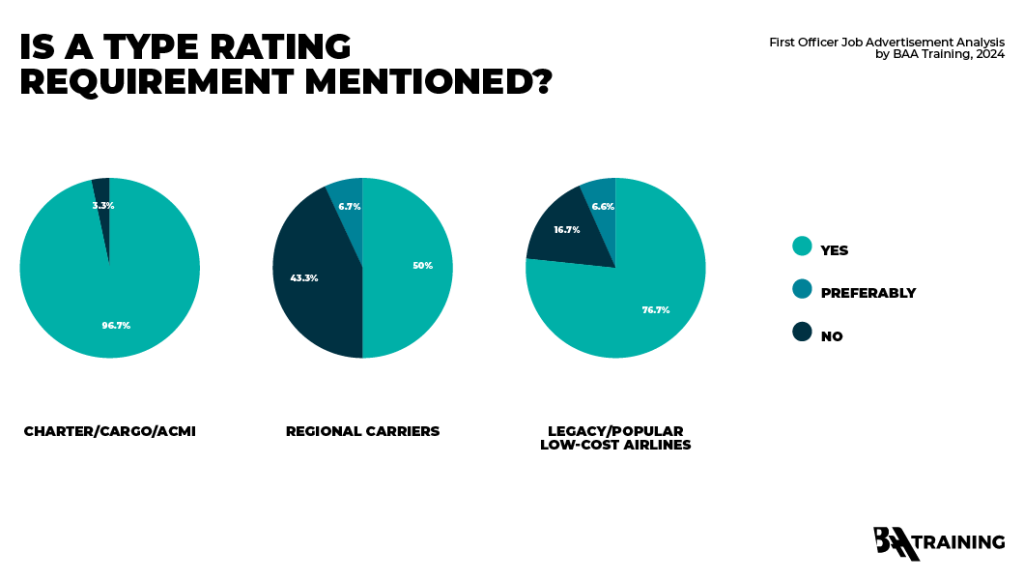

Another obligatory condition to engage in commercial operations and operate aircraft with a maximum take-off weight exceeding 5,700 kg is completing a Type Rating. It has long been debated whether finding a sponsored Type Rating from an airline is feasible, with many believing it often depends on luck, effort, or a combination of both.

The research findings show that the vast majority of legacy/popular low-costs (76,7%) and ACMI/charter/cargo (96,7%) airlines do require a current Type Rating. However, a different trend emerges when studying Type Rating requirements among regional airlines. Only half of them (50%) strictly require a valid Type Rating, while 43,3% indicate that a Type Rating is not required, followed by 6,7% stating that it is preferable but not critical.

The message is clear—a self-funded Type Rating remains the fastest track to an airline career. However, there is a promising opportunity for those starting their career with a regional airline.

Nevertheless, there might be some bias involved as further clarification is needed on what precisely “no Type Rating required” means. Some of the job vacancies may imply the Type Rating is fully reimbursed by the airline, while others might mean it is sponsored by the airline with a bonding period, where you pay off the Type Rating cost through your salary. Another interpretation could be that you are free to apply as a Non-Type Rated (NTR) candidate, with the training covered either fully or partially by the airline.

In any event, the data found offers promising prospects in terms of Type Rating for individuals constrained by financial limitations.

Flight experience on type requirements

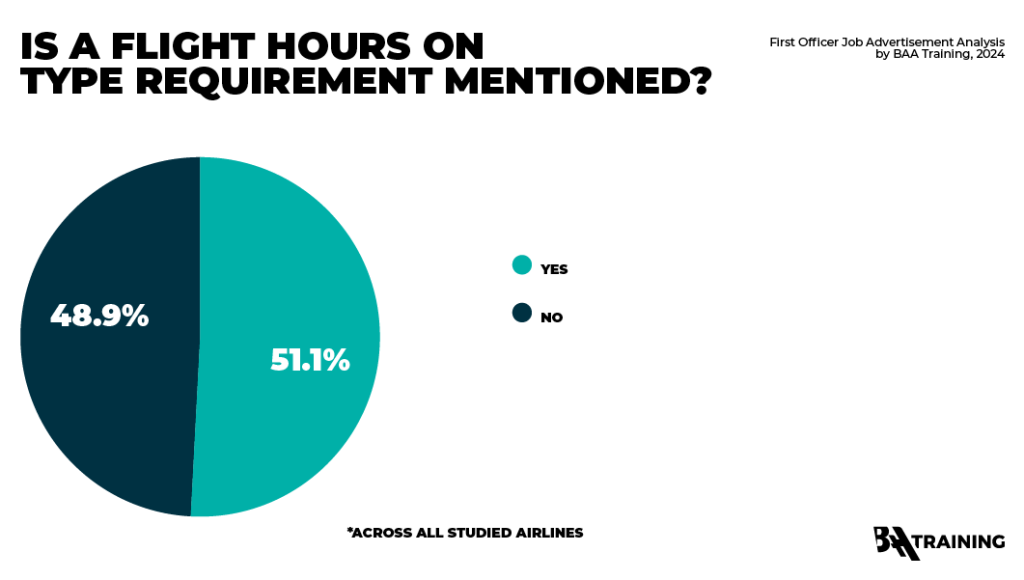

A Type Rating qualifies you to occupy the co-pilot seat when your total flight time is at least 250 flight hours, according to EASA regulations, in contrast to the 1500 hours required by the FAA. However, it often does not guarantee a smooth path to the airline cockpit. Why?

Despite the modest 250 hours of total time being sufficient in Europe, airlines frequently demand a specific number of flown hours on type (e.g., A320 family, B737, or other). This number is sometimes double or triple the minimum total required by regulations.

This discrepancy arises because insurance companies, which insist airlines take all necessary measures to ensure safe operations, advocate for hiring experienced crews, especially considering that studies indicate a peak in accident rates among pilots with around 200 to 400 hours on type. However, this may not solely account for the disparity. The minimum hours on type can also stem from company policy, as airlines may prioritize more experienced pilots, or be established by unions to deter salary reductions by hiring cadets instead of agreeing to higher pay for experience.

Let’s explore whether the pilot shortage has led airlines to become more flexible in waiving their minimum preferred “on type” requirements or at least reducing them.

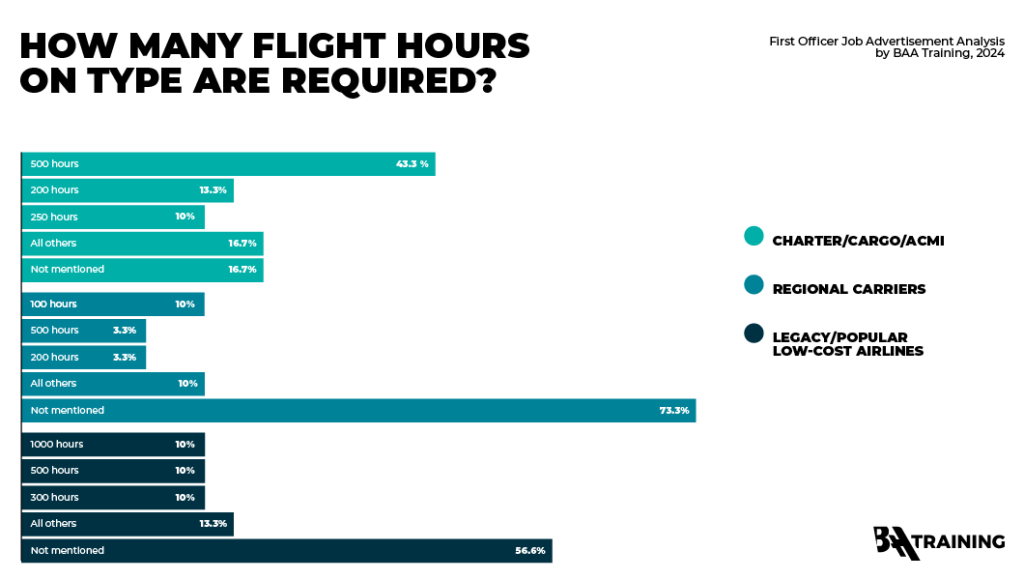

The vast majority of ACMI/charter/cargo (83,3%) do specify a flight hours on type requirement. Among these, the majority (43,3%) seek 500 hours on type, while 13,3% require 200 hours on type, and 10% prefer 250 hours on type.

Only 26,7% of regional airlines have such a listing. However, this can be linked to the fact that a high percentage of them do not ask for a Type Rating, as explained in the previous section. Consequently, no flight hours on type would be requested. Still, among those that do mention it, requirements range from 100 hours on type to 200 hours on type.

Similar ARTICLES

For legacy/popular low-costs airline job ads, 43,3% mention flight hours on type. Among those that do specify, preferences include 300 hours on type, 500 hours on type, and 1000 hours on type, all equally prevalent.

Compared to ten years ago when a 500-hour rule was standard, the findings suggest a more favorable situation for pilots. They can potentially try their luck applying to regional or some ACMI or charter airlines with 100-200 hours on type. Additionally, the majority of legacy/popular low-costs and regional airlines do not indicate any flight hours on type requirement. However, among “all others,” options with 1500 and even 2000 flight hours on type appear, making the situation a bit ambiguous.

However, the paradox remains that to accumulate X hours on type, one needs an airline job, but finding an airline job with less than X hours on type can be challenging. The recommendation is to seek a Type Rating with an airline employment guarantee as a single package to accumulate hours on type within the company. For those without a CPL license, an airline cadet program is also a safer option to enter an airline in the future and avoid being a “direct entry” low-time candidate.

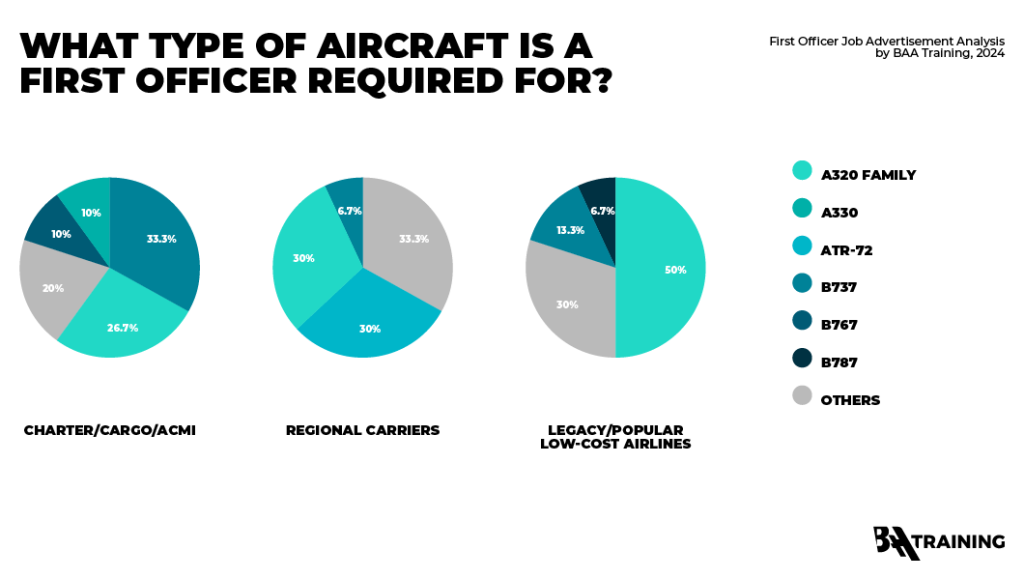

Most popular aircraft types

Now that we have discussed flight hours on type, let’s explore what type of aircraft First Officers are mostly needed for.

Legacy/popular low-cost airlines are mostly in need of A320 First Officers (50% of all vacancies), whereas ACMI/charter/cargo airlines are mostly after B737 First Officers (33,3%). Regional carriers require A320 and ATR-72 First Officers (30% for both).

Overall, regional airlines operate the widest spectrum of aircraft, including A320, ATR-72, B737, Embraer 190, Bombardier CRJ-700, Bombardier CRJ-100, and Fokker 50.

A piece of advice for those deciding on which Type Rating to pursue is to remember that Airbus A320 Type Rating and B737 Type Rating would offer the most opportunities in the European market. However, less common types like ATR-72, E190, Bombardier CRJ-700, or others will likely face less competition, making them a strategic choice.

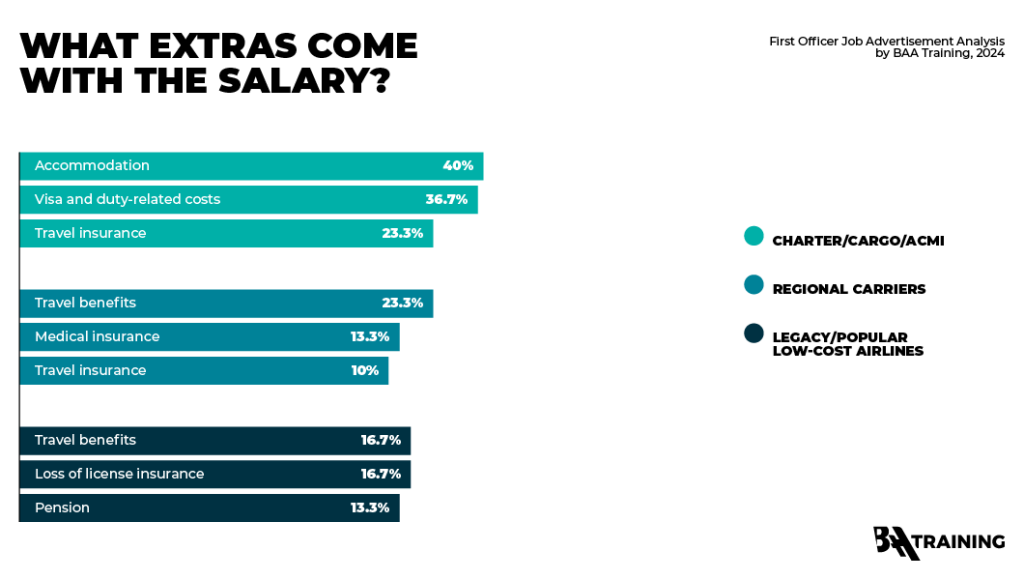

Extras that come with the salary

Regarding offerings and perks, ACMI/charter/cargo airlines mention them in their job ads more frequently than their counterparts. They typically offer a wider variety of benefits, such as covering accommodation costs (mentioned in 40% of job ads), visa and duty travel expenses (36,7%), loss of license insurance (23,3%), travel insurance (23,3%), block hour payment (16,7%), and commuting contracts (13,3%). Additionally, exclusive benefits for this category include per diem payments and monthly inflation coverage.

For legacy/popular low-cost airlines, it is assumed that over half of job ads do not mention benefits because they may not feel the need to advertise extensively. There is a perception that working for such airlines is a desired goal for many pilots, possibly making these airlines less inclined to publicly announce their advantages. Most legacy airline job ads were found on company career pages rather than third-party websites, supporting this notion.

Regional airlines offer travel benefits on the airline’s flights for the pilot and their relatives, along with health insurance coverage and travel insurance.

Your PILOT CAREER

starts with a first click

Salary offered

Unfortunately, it is quite uncommon for pilot job ads to provide salary information or a salary range. In total, such details were listed in less than 5% of all the job ads analyzed. Consequently, no correlation between the offered salary and application requirements or benefits provided could be identified. Additionally, no trend can be observed regarding which category of airlines offers higher salaries.

Still, salary ranges of €55,000 – €90,000 and €100,000 – €150,000+ per year appeared in only a couple of all the job ads analyzed.

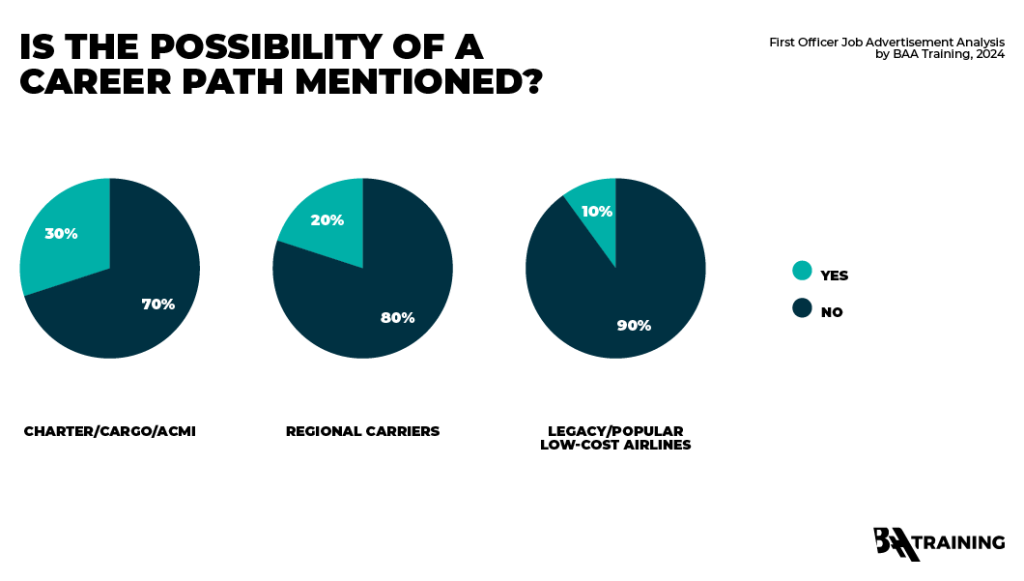

Upgrade and/or career possibilities

Phrases like “fast upgrade to captain,” “possibility to transition to an office position,” and “opportunities for career advancement within the company” were encountered, but such listings are uncommon, with only 10% of legacy/popular low-costs, 30% of ACMI/charter/cargo, and 20% of regional airlines mentioning career possibilities in their First Officer job ads.

However, in general, regional airlines often offer quicker pathways to captaincy compared to legacy careers, where waiting lists for captain positions tend to be long.

Although not a part of this study, the fact that pilots at major US airlines are avoiding the upgrade to captain contradicts the common belief that everyone strives to achieve it as soon as possible. At United Airlines, approximately half of the captain vacancies remain unfilled due to insufficient interest from first officers, while at American Airlines, over 7,000 pilots have opted out of captain upgrades, with the number doubling in the past seven years.

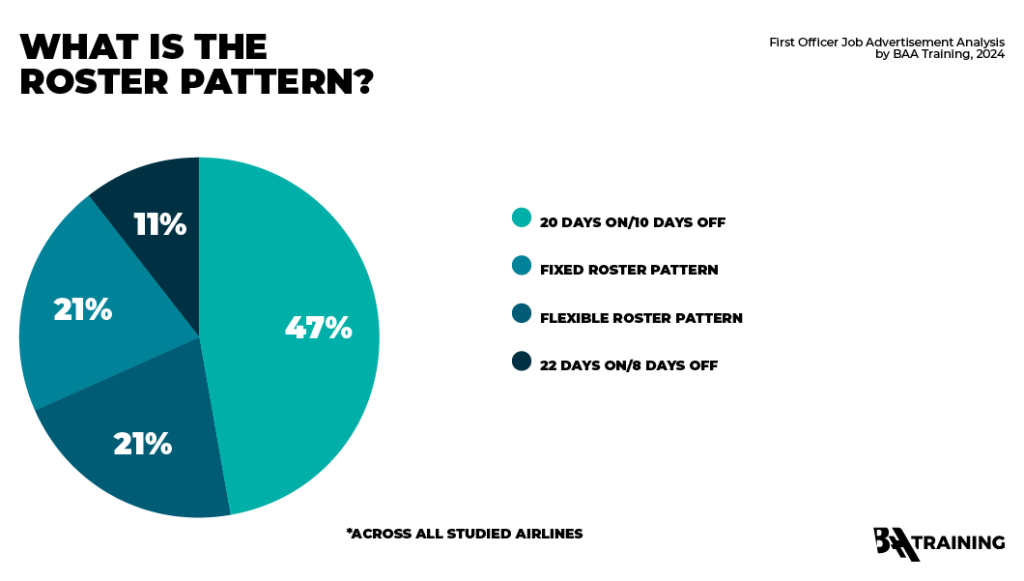

Roster patterns

The most popular roster pattern across all airlines is 20 days ON and 10 days OFF, with ACMI/charter/cargo airlines being the category where this pattern is mentioned more often compared to others. An alternative pattern that appeared several times in legacy/popular low-cost airline job ads is 22 days ON and 8 days OFF. Regional airline job ads also listed other options, such as fixed patterns of 5:2:5:3 or 5:4:5:3.

Summary of findings

Let us now draw the main conclusions from the analysis of airline First Officer job ads. The first hypothesis suggested that airlines are creating better conditions to attract more pilots, while the second hypothesis proposed that the requirements to apply for a First Officer position are not decreasing.

Hypothesis 1: Findings

Although the analysis lacks crucial salary information for a conclusive insight, some helpful insights emerge:

• While there are industry talks of airlines increasingly sponsoring Type Ratings for non-Type Rated pilots, only 25,6% of job ads studied omit Type Rating as a requirement, possibly suggesting available financing.

• ACMI/charter/cargo pilots can expect a broader range of benefits, including coverage for accommodation, visas, duty travel expenses, loss of license insurance, and block hour payment.

• The most prevalent roster pattern across all airlines is 20 days ON and 10 days OFF, with other flexible and fixed patterns also present.

Hypothesis 2: Findings

This hypothesis appears to partially hold true based on research results, with airlines often seeking additional certifications and/or requirements beyond regulatory minimums:

• 17,31% of job ads specify English ICAO level 5, although level 4 is generally acceptable, with other languages such as Spanish, German, Dutch, French, and others also requested by some airlines.

• 51,1% of all job ads have a flight hours on type requirement listed, with the ACMI/charter/cargo airlines category mentioning this aspect more frequently than the other two categories. An Ab Initio or Type Rating cadet program can be a safe way to avoid having difficulty collecting hours to become eligible for airline operations.

• Regional airlines tend to be easier to enter, with only 50% requiring a Type Rating and 73,3% not specifying minimum hours on type.

A320 First Officer positions are predominantly advertised by legacy/popular low-cost and regional airlines (these are also looking for ATR-72 First Officers), while B737 pilots are more in demand in the ACMI/charter/cargo sectors.

Last but not least, there is a higher volume of job ads for ACMI/charter/cargo positions compared to other airlines online. This trend likely reflects the booming growth and increased demand in the ACMI sector. Airlines are increasingly interested in expanding their fleets without the long-term commitments associated with aircraft ownership, driving a surge in ACMI leasing activity.

The information provided in this article is for informational purposes only. The views and opinions expressed herein are those of the author and do not necessarily reflect the official policy or position of any organization. Additionally, please note that the findings presented are derived from recently posted and currently active pilot job ads in the market, intended solely for the purpose of observing trends. Individual conditions and circumstances should be carefully considered, and readers are encouraged to conduct further research before making any decisions based on the information provided in this article.